Auto-detect bank & wallet SMS

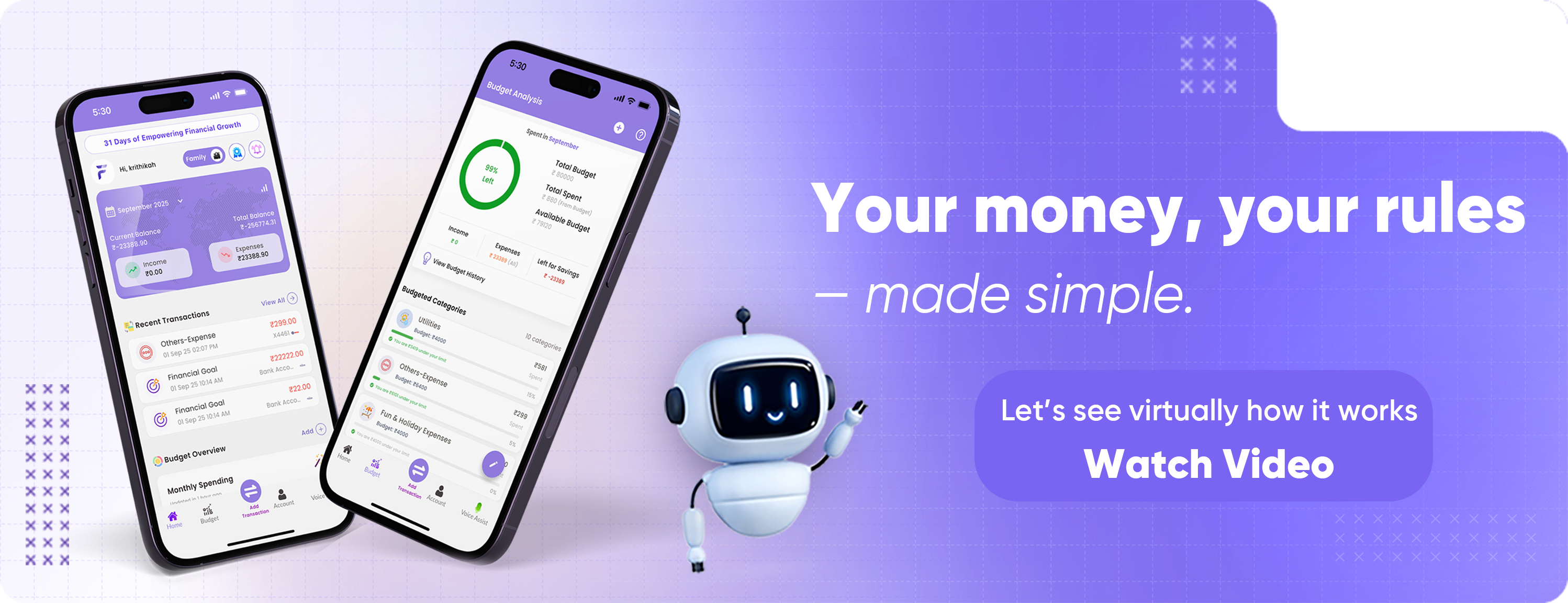

About Fintastics

Fintastics is your smart financial companion designed to simplify money management. We combine powerful automation, AI-driven insights, and seamless tracking to help you stay on top of your finances with ease.

Auto SMS Expense Tracking

Automatically track expenses from SMS notifications—no manual entry, no missed transactions, effortless tracking.

Smart & Fully Functional

Budgeting, reminders, Smart Home Sync and AI financial advice—all tools you need to manage money easily.

Safe & Protected

Bank-grade encryption safeguards your data, ensuring privacy and security for all financial information.

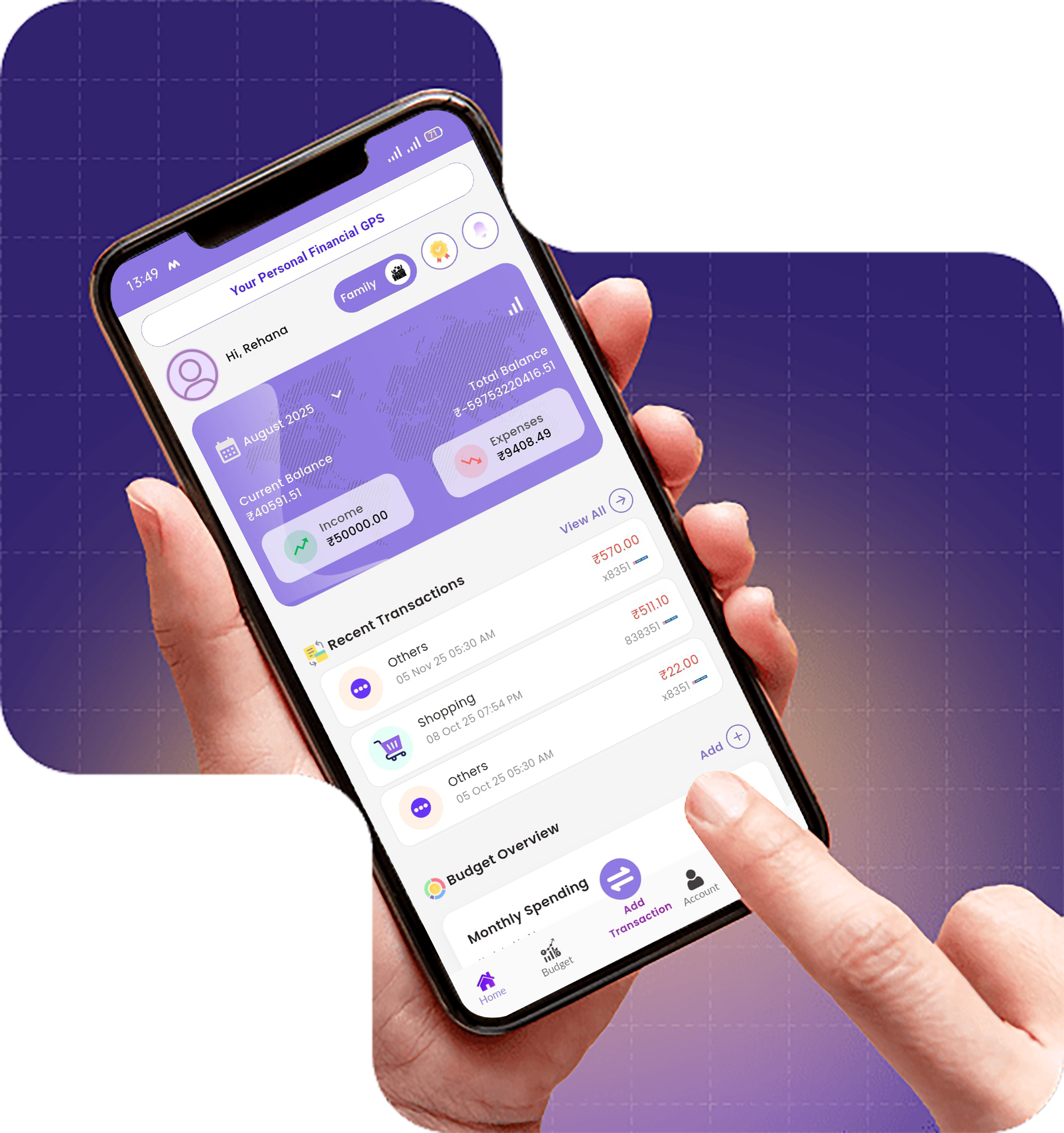

All your finances in one place

Fintastics helps you stay in control with SMS auto transaction tracking, smart budgeting, and easy expense tracking. Manage your money seamlessly — all in one app.

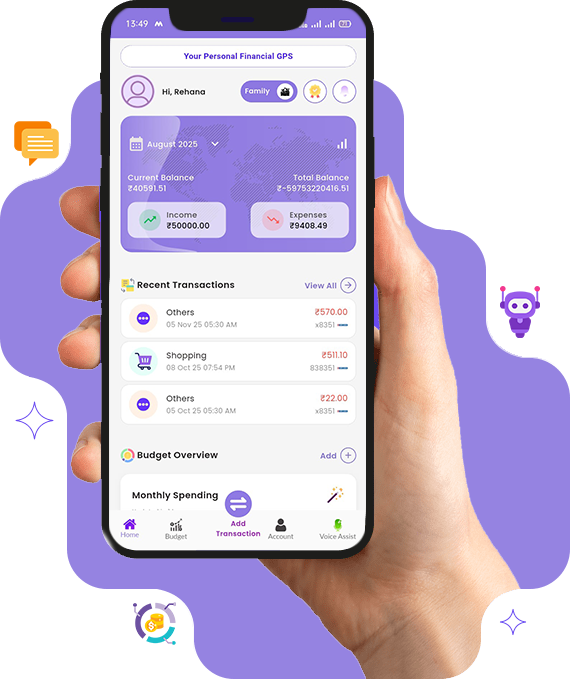

Master Your Finances with Powerful Dashboard Insights.

Fintastics is your all-in-one Expense Tracker and Money Manager App. Track income, expenses, and bills effortlessly with a Unified Dashboard, and gain smart monthly insights to manage your cash flow better.

Track Budgets & Expenses Easily with Fintastics’ Virtual Passbook

Fintastics is your all-in-one Expense Tracker and Money Manager App — helping you monitor income, spending, and savings with clarity and confidence.

Track Every Transaction with Smart Insights — Effortlessly.

Fintastics automatically organizes your finances. As an intelligent Expense Tracker and Money Manager App, it provides AI-powered insights, reminders, and spending analysis to help you reduce costs and save smarter.

Accelerate your financial growth with our intelligent expense tracking app.

Fintastics is an AI-integrated expense tracker and budget management app that streamlines your finances. Effortlessly track transactions, bills, loans, credit cards, and wallets while receiving smart AI-driven insights to optimize spending. Achieve financial goals with automated reminders, intelligent budgeting, and real-time tracking—all secured and seamlessly organized in one user-friendly platform.

Next-Gen Transaction Entry, Simplified

SMS Auto Tracking

Automatically captures and records your bank, wallet, and card transactions directly from SMS alerts, saving time, preventing missed entries, and keeping your expense list accurate.

Real-time expense updates

Zero manual entry

AI Voice Entry

Just speak your expense or income in any language; AI instantly converts it into a categorized transaction entry, simplifying on-the-go financial tracking and reporting.

Voice-Powered Entry

Multi-Language Recognition

AI-Powered Categorization

Image Scanning

Snap bills, receipts, or invoices; the app automatically extracts amount, date, and merchant details to create accurate transactions, reducing errors and saving valuable time.

OCR receipt scanning

Auto-extract data

Store bill images

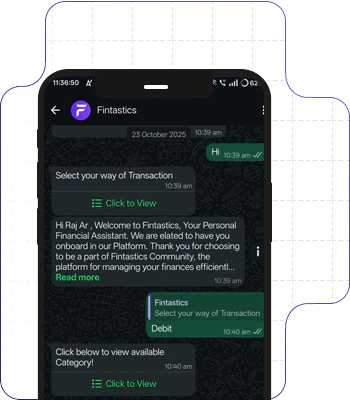

WhatsApp Copy & Paste

Copy any transaction details from WhatsApp messages and paste into the app; it detects amount, date, and category instantly, ensuring effortless expense management.

Quick paste system

Auto-detect details

Ideal for group expenses

Image Upload

Upload bills, payment proofs, or screenshots into the app; it automatically extracts essential information, updates your expense list, and keeps records neatly organized.

Bulk image upload

Auto data extraction

Secure image storage

Got questions? We’ve got answers.

Learn how Fintastics helps you track expenses, manage budgets, and take control of your finances effortlessly.

Read latest story

Discover the latest financial insights with Fintastics — your go-to source for smart tips on saving, budgeting, and debt management. Stay informed, stay empowered, and take control of your financial journey.

The Smart Way to Say Goodbye to Money Leaks: Best Expense Tracker Apps in India That Work for Everyone

Struggling to Track Every Rupee? Here’s How the Best Expense Management Apps Make It Effortless

Need support?

We’re here to help you anytime. Contact our team for quick assistance