Loan Details

What formula is used?

Amortization (first 12 months)

Amortization (first 12 months)

| Month | EMI | Interest | Principal | Balance |

|---|

India’s Credit Market at a Glance

India's credit market is growing rapidly, currently ranking as the 4th largest in the world with a compound annual growth rate (CAGR) of over 11%. Personal loans and credit cards make up 78% of total credit lending in the country, with a significant share being short‑term credit. Borrowers should factor in the EMI (Equated Monthly Installment) when planning their finances for both the present and the future. To determine the exact EMI amount to repay, it’s best to use a reliable EMI calculator and understand how it works to ensure accurate loan‑repayment planning.

Factors Affecting Your Due Amount

- Loan Tenure: The duration of the loan impacts your EMI. A shorter tenure increases EMI, while a longer tenure reduces it.

- Interest Rate: A crucial factor in EMI calculation. Lower rates reduce overall repayment. Comparing loan options can help you secure a better rate.

- Loan Amount: EMI is directly proportional to the amount borrowed. Choosing a suitable amount based on your capacity ensures manageable repayments.

How Can an Online EMI Calculator Help You?

- Estimate monthly instalments based on amount, tenure, and interest rate.

- Compare different loan options to choose the best fit for your budget.

- Plan efficiently by understanding total interest payable and overall loan cost.

- Save time by eliminating manual calculations and reducing uncertainty.

The Formula to Determine Loan EMI

We use the standard EMI formula for accuracy:

EMI = P × r × (1 + r)n ÷ ((1 + r)n − 1)

- P = Loan principal amount

- r = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- n = Loan tenure in months

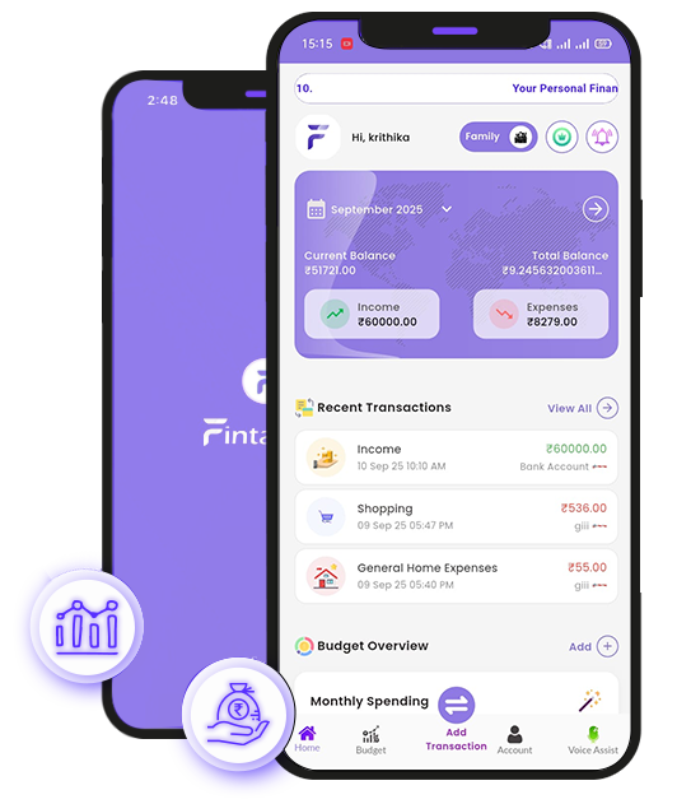

How to Use Fintastics Online EMI Calculator

- Enter the loan amount – Input the total amount you wish to borrow.

- Set the interest rate – Adjust the rate according to your loan offer.

- Choose the tenure – Select the loan duration (months or years).

- View instant results – EMI, total interest, and total payable appear with a graphical breakdown.

- Enjoy a fast, user‑friendly experience for quick and accurate planning.

Advantages of Using Fintastics EMI Calculator

- Instant & Accurate – Eliminates manual errors and provides precise results.

- User‑Friendly Interface – Simple design for hassle‑free calculations.

- Customisable Inputs – Adjust loan details to compare scenarios.

- Graphical Representation – Visualises the EMI breakdown with a chart.

- Time‑Saving & Free – Get results instantly at no cost.